Financial Planning Tips for Millennials

Most of us behave like this in matters related to financial planning. A rude shock can only change us. But we can go one step forward by being preemptive with our foresightedness.

A life insurance agency in LIC is a noble profession respected and needed by anyone having an income. A person practicing the profession has an independent will of his own and an ambition to grow as an individual. He wants to be self-dependent and have a steady income. Let us consider below the salient features that the profession promises

Mr.Gautam Bose was a hard-working, able, and physically agile gentleman working for India realtors as a Construction Supervisor in Kolkata. He was living in Amtala, a small suburb in the outskirts of Kolkata along with his wife and two children. His children, both sons, were 10 and 4 years old respectively. He was himself 35 years of age and his wife 31 years. Every day he went on his Hero -Honda bike to his site office at Behala in Kolkata and then visit his corporate office nearby his site office before returning home to Amtala. He had been employed with the construction company for 10 years. On a fateful day, Mr.Gautam while on his return journey back home came under the wheels of a speeding truck. He expired at the hospital after 2 days at a hospital in Kolkata. Investigation revealed that Late Gautam Bose had only 5 Lakhs LIC policy and very little savings. According to his wife, the amount will not be sufficient to compensate the family to meet the expenses of the family for more than 1 or 2 years. We may conclude that the life insurance of Late Gautam Bose was inadequate.

Such instances of families in distress due to poor financial planning is frequent in India. Most people are not financially wise and continue to take risks inadvertently without being guided due to their conditional thought process. Herein, life insurance agents can play the role of an advisor.

In the life insurance business, higher age is not a barrier to appointment or success. The minimum age for joining the profession is 18 years(completed) and the minimum qualification has to be the 12th standard (10+2) or HSC pass

One of the schemes that LIC offers to recruit agents in urban areas is by recruiting agents under the City Career Agency scheme.

A City Career Agent (CCA) is provided with a monthly stipend of Rs. 7000 per month for one year. Anyone looking for additional financial support during the first year of agency career

A LIC agent is paid in the form of commissions. Compensation paid to a LIC Agency is the “best paid hard work” unique to sellers of financial security.

The sale of life insurance gives repeated commission payments year after year for one sale and they continue even after the agent resigns or dies provided, the agency has the required business in force.

The New Businesses or in other words, new policies submitted in the first year of the policy, receive a First-year commission.

Renewal premiums deposited in subsequent years receive renewal commissions.

The rate of commission is different for first-year commissions, and renewal commissions.

Again, the first-year commission and subsequent year commission directly vary with the duration of the premium payment terms of the policy.

The agent receives a maximum First commission of up to 25% of the premium paid by the policyholder.

Bonus commission on the First commission is paid at the rate of 40% of the first-year eligible premium.

Under standard tables and plans, the renewal commission varies from 7.5 to 5% of the premium paid for the policies in subsequent years.

Single premium policies are paid a one-time 2% commission

With the recurring income- a feature of the compensation, income steadily grows every year

After the agency has completed 5 years or more of continuous service, the agent will be paid compensation continuously even after termination from the agency subject to fulfilment of certain criteria.

The hereditary commission is paid to the nominee as compensation if an agent has continuously served the corporation for more than 2 years or more.

A gratuity of Rs.300000/- is paid to the agent if he has completed the Minimum Amount of Business for 15 years, called “qualifying years”. The total amount of gratuity payable depends upon the total number of qualifying years and the amount of commission earned in the “qualifying years” out of the last 15 years of the agency. Gratuity is payable at age 60/65 years as per the choice of the agent.

Gratuity is also payable for those who may have resigned or terminated, subject to fulfillment of the conditions.

Gratuity is also payable on the death of an agent when the agency was in force and the amount depends upon the number of “qualifying years” completed and the renewal commission earned in those “qualifying years”.

If you were an agent of LIC or any other insurer and your agency was terminated due to deficiency in procuring minimum business quota and have not committed any financial fraud, such terminated agent may seek re-appointment with LIC subject to fulfillment of some conditions as prescribed by IRDA and LIC.

A LIC Agent in order to survive in his agency must submit either 12 different lives or Rs.100000 FPI or 6 lives with 50000 FPI every agency year.

You should not be satisfied with merely completing the business quota of the Minimum Amount Business (MAB). It will not build for you a steady flow of income stream. You must aim for something higher and strive to achieve it.

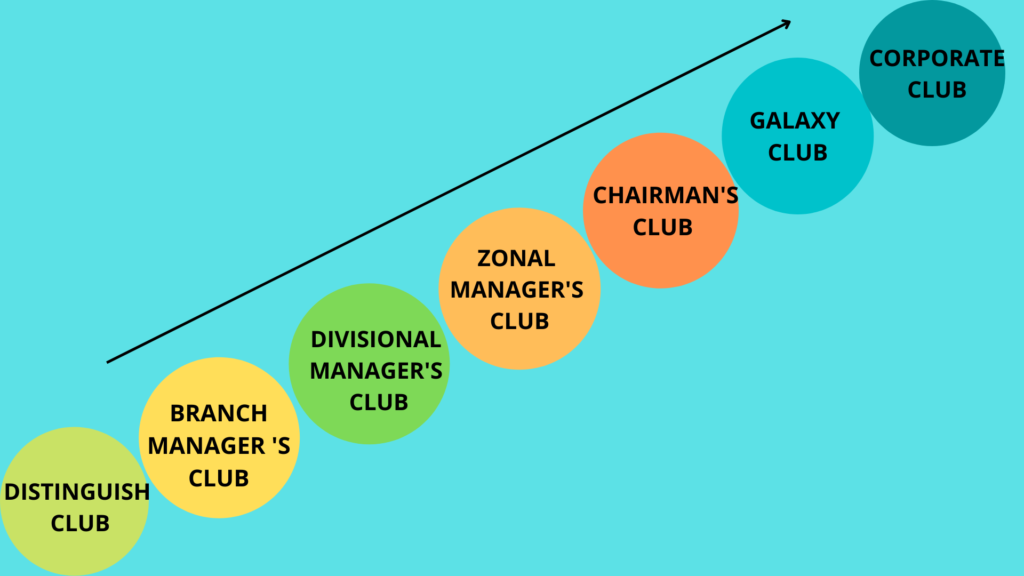

To benefit optimally from the career, you must become a club member agent.

Following additional benefits are given over and above the commissions payable:

The total monetary equivalent of all the above benefits ranges from Rs 5,500 to 5,50,000, depending upon the level of Club Membership

The Million Dollar Round Table (MDRT), The Premier Association of Financial Professionals, is an international association of the world’s leading life insurance and financial services professionals. MDRT members demonstrate exceptional professional knowledge, strict ethical conduct, and outstanding client service.

MDRT membership is recognized internationally as the standard of sales excellence in the life insurance and financial services business.

To qualify for the membership of MDRT agents have to earn the prescribed First Year Commission or bring the prescribed First Year Premium during the Calendar year.

This is a salesman’s job and it is neither qualification nor knowledge that can make a successful insurance agent. It is laziness and fear or nervousness that drives a LIC sales agent into failure; and aliveness, enthusiasm, electrified spirit, and activity into success. Enthusiasm, and excitement to remain alive and active is an acquired emotions and not something one gets from birth. It is the inspiration that has been developed within with positivity and responsibility. Hereinbelow, a motivational poem by Herbert Kauffman with a good title “Victory” is shared for your reading and inspiration.

VICTORY

You are the man who used to boast

That you’d achieve the uttermost,

Some day.

You merely wished a show,

To demonstrate how much you know

And prove the distance you can go . . . .

Another year we’ve just passed through.

What new ideas came to you?

How many big things did you do?

Time . . . left twelve fresh months in your care

How many of them did you share

With opportunity and dare

Again where you so often missed?

We do not find you on the list of Makers Good.

Explain the fact!

Ah no, ’twas not the chance you lacked!

As usual-you failed to act!

Habit is something developed by a man by doing things repeatedly. If a man grows it only takes place because he has developed good habits. If he is a failure in his enterprises, it is because he has developed bad habits unknowingly. The cure for bad habits is to develop good habits. It is like taking medicines when you are sick. If you are sick and do not take medicines, then you are likely to remain sick or your health condition deteriorates. But if you consume medicines then in all likelihood your chance to get cured is 99%. Good habits are the right medicines for you and bad habits are taking poison voluntarily every day.

The bad habits that make an agency fail or bar growth are “laziness” and “waiting for the right moment to strike”. In LIC Agency performance comes only when an agent is “active” and “acts with energy, force, and enthusiasm”. “Knowledge” or “plan choice” is only secondary to performance.

In his own words, Frank Bettger says:

“Selling is the easiest job in the world if you work it hard, but the hardest job in the world if you try to work it easy”.

How to get organized for performance as a LIC Agent?

A sales coach, who desires to stay anonymous says:

“Any man with ordinary ability who will go out and earnestly tell his story to four or five people every day will be a successful LIC agent”.

The foundation of LIC Agency business is:

“You can’t collect your commission until you make the sale;

You can’t make the sale till you fill out the proposal;

You can’t fill out the proposal till you have an interview;

And you can’t have an interview till you make the call”.

Most of us behave like this in matters related to financial planning. A rude shock can only change us. But we can go one step forward by being preemptive with our foresightedness.

It is a matter of concern for millennials to build assets that provides recurring income for long term preferably for 100 years.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Fill in your details and we’ll get back to you in no time.

No products in the cart.

Explore Food ItemsNo products in the cart.