Financial Planning Tips for Millennials

Most of us behave like this in matters related to financial planning. A rude shock can only change us. But we can go one step forward by being preemptive with our foresightedness.

Surojit , was deputed as an embassy employee at Kabul in the year 2008.At 08-30AM he was on phone with his home when he heard a defeaning noise of a bomb attack.He hung up by saying “Something bad may have happened here.”

Panic set in. There were 58 deaths. Thank god, Surojit was saved. After two days Surojit established communication with his family. He was scared and literally crying. He told his wife how much he loved her and their two children. He was at peace to know that they are safe. He wanted to share his finance portfolio with his wife. He expressed to her what she has to do for them if anything happens to him. His wife was not in mind to listen to all this. He was dumping all his responsibilities on her. He was feeling helpless. In his mind, he was cursing himself.

Immediately, after he returned home he sat with his wife and drafted his financial plan without any delay. Fear motivated him.

Most of us behave like this in matters related to financial planning. A rude shock can only change us. But we can go one step forward by being preemptive with our foresightedness.

In “Alice in Wonderland” the cat tells Alice “If you walk long enough, you will surely get somewhere”. In most cases we mortals don’t accept the advice that the cat gave to Alice on matters concerned with money. Though unacceptable it may seem, many of us don’t have any plan for savings and investment. Neither are we seriously concerned about financial security. In the end, we regret the chances we didn’t take.

An individual leads living their financial life by passing through various stages of earning cycle. Those are namely :

At this is stage the person starts earning with the intention to settle down. Right from the first step , it is important to adopt good saving habits.He must learn how to prepare a budget, saving and investing. You may use our budgeting calculator for the purpose as a guide. Balancing the expenses and savings at this stage helps in achieving financial goals in a long way

During this phase earnings increase but expenses rise as fast as one’s income. The various financial needs at this stage are:

At this stage of life, the challenge is the need to accurately project cash flow needs after retirement to address personal and family concerns.

In the past, retirement planning were being built with the assumption that most individuals would live 10-15 years after retirement. But the present millennials are predicted to be living 30-35 years after retirement.

The various financial needs at this position of life are:

Increase in life expectancy has made retirement an extended period of financial life. The financial needs of this stage are given hereunder:

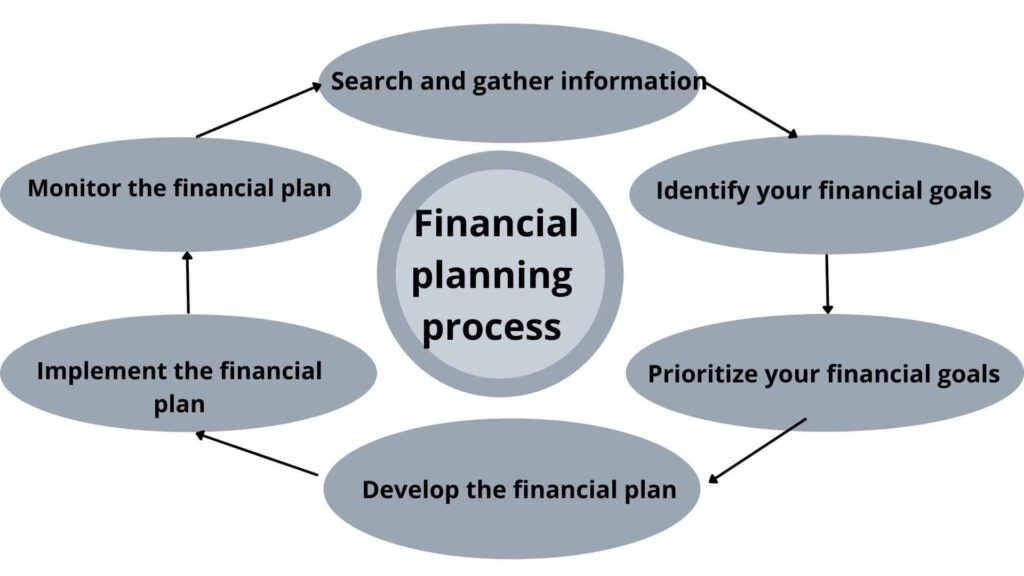

This process must be seriously developed from the initial phase of financial life cycle.

At this stage, a person should collect information and obtain relevant knowledge from dependable sources on various avenues to save and invest. During this investigative stage, he must understand the risk associated with the savings or investment instruments. As a note of warning, it may be noted that many people in our country have lost their hard earned money by investing in risky and non-dependable instruments.

At this stage, it is also necessary to be watchful of your spending and saving habits. If you feel it is necessary, then you must replace your bad habits with good habits.

It is absolutely necessary to determine where the individual wants to reach in the future. In other words, his personal and financial goals have to be defined within a time frame for each goal.

Information gathered has to be analyzed for assessing the current financial situation and habits vis a vis the desired goals. In this phase of inquiry and analysis, it is necessary to develop an understanding of current assets, long-term assets, liabilities, cash flow, current insurance coverage, and tax strategies.

A financial plan has to be worked out, factoring in the risk appetite of the individual.

As family size , age composition within members change, the family’s needs change. Therefore, the financial plan has to be reviewed and updated from time to time.

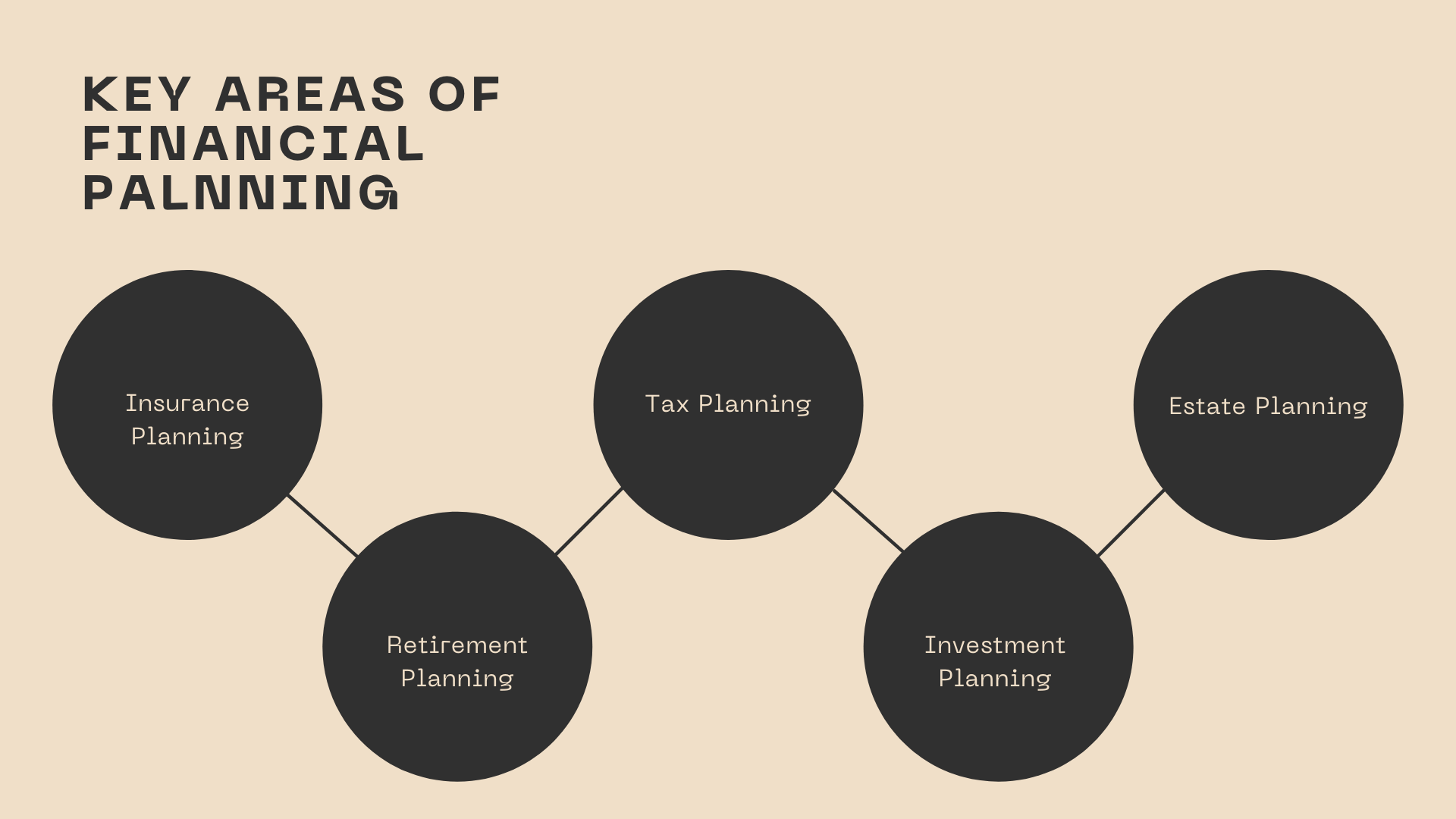

The following questions must have their answer when a person is engaged in insurance planning:

What type of insurance to buy?

What amount of cover is required?

What benefits can be availed by taking the insurance policy or policies?

The questions have to be answered one by one. Let us begin by answering the first question first.

What type of Insurance to buy?

The factors to consider are wealth, income and expense requirement of dependents, lifestyle of the purchaser, any special needs for a disabled child who will never be self-supporting, any debts that has to be paid off such as mortgage, car loan or credit card dues.

What amount of cover is needed or required?

The method to arrive at the quantum maybe:

Benefits of life insurance

You may utilise our calculator to arrive at the amount of Life Insurance you will need

Human life value calculates the quantum of life insurance needed to provide for family in case of absence of bread earner.

You may use our Human Life Value calculator

Many people consider retirement as the best stage in their life cycle. Why? It is at this stage of their life they get freedom. Freedom from classwork as they did while in school, freedom from writing examination while in college and university, freedom from attending interviews for getting a job, freedom from answering the demands of the job either from a supervisor or client. It is at this stage he gets real FREEDOM. He can do whatever he likes to do with his time. He may travel, read books, spend more time with his family or sing and dance. At this time, he does not have to wake up early in the morning and prepare to go to his place of work. His challenges are reduced. However, if he has not prepared for his retirement, then this is likely to be his worst phase of his life.

Retirement planning is a neglected area in financial planning. It does not take off because of the following factors:

-Attitude is I am young. It is too early to start retirement planning. It therefore gets a very late start.

-Inflation is another factor that’s upsets retirement planning. The present savings may not be sufficient. It is necessary to review strategy periodically and modify it with changes in inflation rate and interest rates.

The need for a retirement income Is necessary for an INDEPENDENT, worry free, happy old age. Therefore, planning for it is absolutely necessary. The quantum of retirement income may differ from person to person, family to family. But the quantum of retirement income should be as much which should satisfy you as an old citizen. If you start early, amount of monthly/yearly savings required will be lesser than when you start late. Why? Because your MONEY saved can earn interest for a longer period than if your start late.

You may use our Retirement planning calculator for determining your goal and strategy

Income tax is payable on income made within a financial year by an individual. Yet there is a necessity for tax planning in order to save taxes. Any savings in income tax increases the net income of the person. As the dictum goes “A rupee saved is a rupee earned”.

Use our income tax calculator to determine and review your income tax and strategize your income tax savings.

When doing investment planning, it is necessary to understand that investment decision is not a layman’s exercise. Many people invest in stocks, bonds, mutual funds and in deposits giving fixed rate of interest on the advice of others. In many cases this advice has not been worthy. People have lost much money because of listening to such advice.

Many holds a view that rate of return which an investor can earn is dependent on the degree of risk he is able to accept. This brings us to the concepts of uncertainty, risk and certainty of investments. Herein we may quote J.S. Osteryoung in his book on “Capital Budgeting: Long term asset selection”,Columbus,Ohio,Grid,1979,page 155, wherein he writes “Risk refers to the set of unique outcomes for a given event which can be assigned probabilities while uncertainty refers to outcomes of a given event which we are too unsure to be assigned probabilities”. Uncertainty implies looking for speculative returns. Risk situation is one in which the probability of a particular event occurring are somewhat probable and can be estimated. Estimates are never accurate as they are dependent on various economic factors but at least it will be an informed and analysed decision.

Benjamin Graham in his book “The Intelligent Investor” on page 88 of First Collins Business Essentials published 2005 of the book writes that “The rate of return sought should be dependent, rather, on the amount of intelligent effort the investor is willing and able to bring to bear on his task. The minimum return goes to our passive investor, who wants both safety and freedom from concern. The maximum return would be realized by the alert and enterprising investor who exercises maximum intelligence and skill”.

To conclude, any investor can increase his rate of return on his investments by maximizing his decision taking abilities and research.

What happens to your assets after you pass away?

What happens when you can no longer take care of yourself or your assets?

Your assets is everything that you own.Your self owned proprty,company shares,vehicle ownership,Savings Bank accounts etc. After you pass away all these needs to be transferred to someone.An estate plan lays down who gets what.

Importantly, an estate plan spells out what your loved ones or caregivers are to do when you become incapacitated and when you can no longer take care of yourself.It covers health care,long -term care, who will manage your finances and who will look after your children if necessary.

Common estate planning Myths:

There are two possibilities for succession procedure:

If you don’t leave a will, your estate has to pass through probate court as per mandate of Indian Succession Act.The vesting of the assets take place as under relevant personal laws of Hindus,Muslims and Christians.

To avoid the complications from intestate succession and to ensure smooth transition of assets from the deceased to heirs, to avoid dispute within the family, protect wealth of the deceased, promote tax planning, estate planning must be adopted.

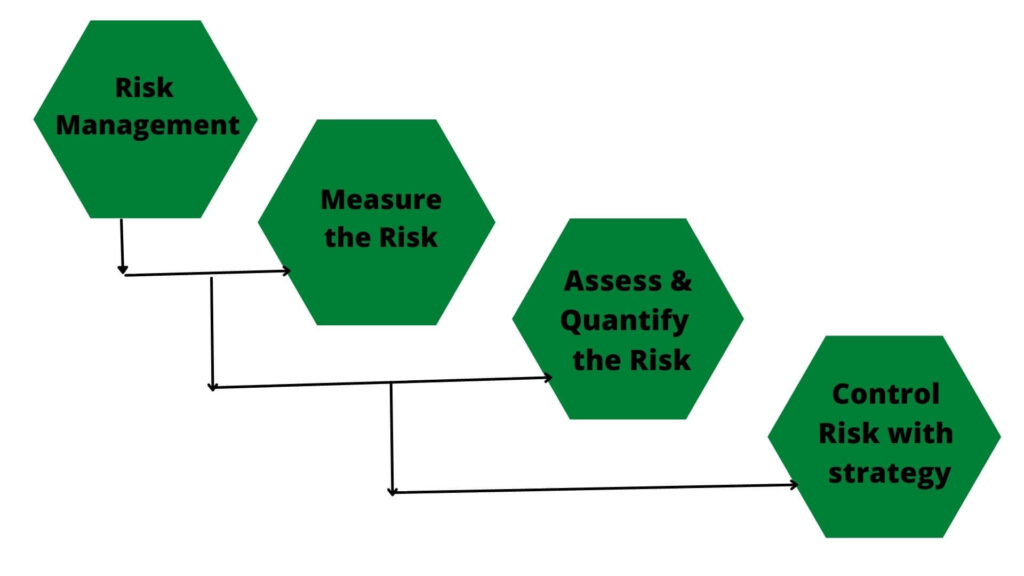

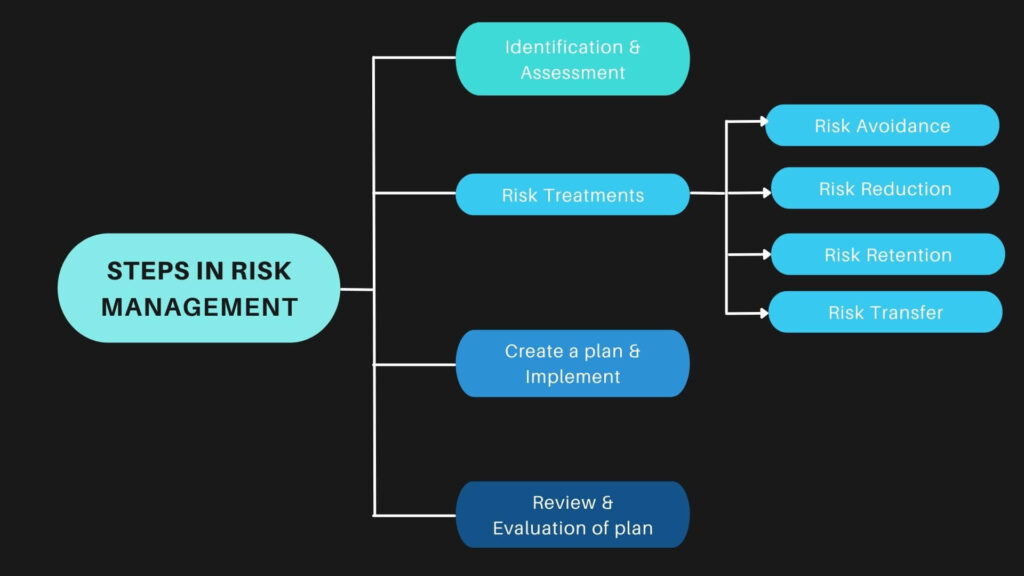

Ideally in risk management, a prioritisation process has to be followed by ordering the risk with the greatest loss and the highest probability of occurrance as the first concern, and risk with lower probability of occurrence and lower loss are of lower concern.

Risks are fundamental, particular, pure, speculative, dynamic or static.

In life insurance, risk classification by insurer determines the charge for a policy .It is a case of pure risk. There is either a possible loss or no loss. But there is no gain from the outcome. The risk classification is based on applicants age, occupation, sex, and health condition.

Fundamental risks are those risks that are natural phenomenon such as flood , earthquake , hurricanes , tornados ,etc.

Particular risks are specific individual factors as robbery , accidents ,etc.

Dynamic risks are those changes that take place in price levels , consumer tastes , technology that results in increased/ decreased income or impact of technology in process of production .

Static risk are those caused due to fire or natural causes affecting anyone.

In case of Pure risk , there is a possible loss or no loss but no gain. Pure risk maybe insured.

Speculative risk are those risks when the possibility is either gain or loss.

Premature Death-Early death of breadwinner causes financial day to day hardship to the dependents. Therefore, a breadwinner has to be adequately insured.

Old age/retirement- There is a risk of retiring without sufficient savings to support post retirement life.

Health risk- Individual suddenly faced with health problem may face loss of income and increase in medical expenses.

Unemployment-An individual who gets unemployed has to live on his savings. The moment his savings gets exhausted , the person may face economic hardships.

Due to damage to an owned house there maybe direct financial loss. Also there maybe consequential loss due to the damaged self owned property.

Insurance is a contractual agreement wherein an insurer agrees to pay to the insured or beneficiary a defined amount upon the occurrence of a specific loss on payment of a stipulated amount called premium by the insured.

The defined amount maybe a fixed amount or all or part of the loss that may have occurred.

The insurer pays the defined amount from the insurance pool. The premium charged on the basis of projection that the premium collected will be sufficient to cover all projected claim payments from the insurance pool.

Insurable interest of a person is the concern for any measurable loss that an individual may suffer on the occurrence of an unfortunate event. In case of a life insurance policy, the beneficiary may utilise the amount received for paying off debts, children’s education expenses, etc.

The risk of any unanticipated loss is transferred from the policyholder to the insurer who also imposes certain conditions to the insured for participating in the insurance pool. The insurer has the prerogative to impose certain named exclusions from the claim such as loss as a result of war or loss of life due to suicide in first three years of the policy.

The following are the benefits that a policyholder gets by purchasing a life insurance policy:

An observation made by former CEO & MD of Star Union Dai-ichi life and shared to media on 26,January 2022 are reproduced herein below in his own words :

“A study by global reinsurance firm Swiss Re has indicated that in India financial protection available to an average policyholder is only 7.8% of the net protection required. The gap is wide and this is in spite of the government licensing 23 life insurers in addition to the public sector LIC to sell life insurance in India.”

“Selling life insurance with sum assured below Rs 25 lakh is a sacrilege on the part of the insurers.

Life insurance protection was needed most by people across India during the mayhem caused by Covid-19, when they were losing not only their loved ones but also their bread-earners. But the protection provided by the life insurance policies in respect of most of the claims settled proved utterly inadequate in terms of the amount of sum assured, not enough even for immediate needs of the family left behind.”

These comments illustrates the need to communicate insurance benefits to Indians in greater measure.

I am happy to share a real life insurance story shared by US Marine veteran ,Cory Schroeder”Life Insurance Found me” on the usefulness of life insurance.In his own words, let us read what he has to say.

” I am a Marine Corps veteran. When I served, I was a member of an elite bomb squad and deployed several times to Iraq. As you may imagine, the camaraderie that existed among those of us in the unit — one that faced risk and danger each day — is unique and deep.

That’s why when one of my fellow Marines, Peter, died in the line of duty, I felt a strong pull to help his family. While I was still deployed, I checked in on his widow, Asia, and their young son, Jacob, who was just 3 when his father died. I offered help as they transitioned into this new life, but one thing I didn’t need to do was offer financial assistance. That’s because Peter had taken care of his family financially with life insurance.”

Now , when the thought for life insurance comes up most millennials prefer a term insurance policies. Term insurance policies serves the purpose of coverage . But it does not have the additional benefits that other policies have.(See our list of benefits from life insurance policies).

Most of us behave like this in matters related to financial planning. A rude shock can only change us. But we can go one step forward by being preemptive with our foresightedness.

It is a matter of concern for millennials to build assets that provides recurring income for long term preferably for 100 years.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Fill in your details and we’ll get back to you in no time.

No products in the cart.

Explore Food ItemsNo products in the cart.